The impact of the outbreak of war between Russia and Ukraine on China's energy and chemical industry

2022-03-03 15:19

The situation in Russia and Ukraine has been affecting the nerves of the whole world. After a period of pulling each other, on the morning of the 24th, war finally broke out between Russia and Ukraine. According to foreign media reports, Russian President Vladimir Putin decided to carry out a special military operation in the Donbas region, and there were also multiple explosions in the Kyiv region of the Ukrainian capital. Behind the complicated geopolitical situation of Russia and Ukraine, of course, is the conflict between the interests of Western countries in Europe and the United States represented by Ukraine and Russia's own interests. So what will be the impact on the supply chain of my country's energy and chemical industry after the outbreak of the war between Russia and Ukraine? With the local turmoil caused by the outbreak of the war, it is bound to affect the export of Russian crude oil, natural gas and other energy sources. While the current new crown pneumonia epidemic has not yet ended, the prospects for global economic recovery are still foggy, and many factors are alternately superimposed. China's energy and chemical industry is suffering The pressure will increase!

Interview record

Interviewee Pang Guanglian: Member of the Standing Committee and Deputy Secretary-General of the Party Committee of China Petroleum and Chemical Industry Federation, Secretary-General of the Foreign Investment Committee, Secretary-General of the China Petroleum and Chemical Industry International Capacity Cooperation Enterprise Alliance

Reporter: Secretary-General Pang, please briefly describe your impact on the global energy and chemical industry after the current Russian-Ukrainian war?

Pang Guanglian: The damage to Europe must be that the second Beixi line is difficult to put into use under the energy sanctions. The natural gas pipeline passing through Ukraine will also be greatly affected. These will inevitably raise the premium of European natural gas and cause global energy prices to rise.

U.S. sanctions on Russia to reduce pressure on China have prompted China and Russia to further deepen cooperation

Reporter: Secretary-General, my country now exports chemicals to Europe through the land passage of Russian Railways. If the United States, France, Germany and other countries launch a new stage of sanctions against Russia, do you think that the import and export of chemicals between China and Europe by land will be affected?

Pang Guanglian: This is definitely not the case.

Europe relies on Russia for 40% of gas Exports of liquefied natural gas (LNG) to Europe are at a record high, and European LNG is operating at full capacity. UK gas prices could quadruple in the event of a conflict, while Russia supplies 20% of the global seaborne ammonia market, supply disruptions could impact fertilizer and food prices and demand, but chemical companies will struggle to pass on higher costs, hurting profit margins. Closing the Druzhba pipeline will cut European ethylene capacity by as much as 11%, propylene capacity by 12%, lower demand growth in Asia, slowing Chinese economy, and already negative polyethylene (PE) margins in Asia.

Reporter: Secretary-General, now Russia and Ukraine have actually gone to war, that is, the situation in Ukraine has developed to the worst. In this case, how do you think the West's response to Russia will affect the petrochemical market?

Pang Guanglian: The rise of petrochemical bulk products is certain, but eventually the two sides will return to the negotiating table.

Reporter: Will Europe and the United States impose sanctions on companies like Gazprom?

Pang Guanglian: Sanctions are for sure. It is estimated that systems such as the military and energy will be on the sanctions list starting from finance.

General situation of natural resources in Russia

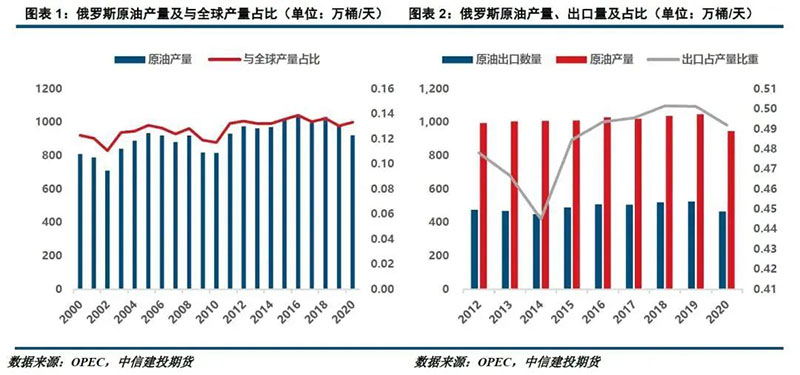

Russia has abundant reserves of natural resources, and because of its relatively mature technology, rich experience in industrial workers, and perfect domestic infrastructure, Russia has always been at the forefront of the world in the development and utilization of resources. By the end of 2021, according to relevant data, Russia's crude oil exports accounted for about 12.1% of the global crude oil export supply, and crude oil production exceeded 10 million barrels per day; Russia is currently the world's second largest dry natural gas country, producing more than 22.5 trillion Tcf per year. of dry natural gas;

Russia is the world's third largest producer of petrochemicals, oil and gas and other energy sources, after Saudi Arabia and the United States.

Therefore, Russia's economic and social development is also very dependent on its own energy exports. The abundant energy resources supply a lot to Russia's economy. Every year, energy exports and related service exports account for more than 25% of Russia's GDP, and energy, oil and gas-related fiscal and tax revenues contribute. two-thirds of Russia's fiscal revenue.

Influence of the Russian-Ukrainian War on the Supply Chain of my country's Energy and Chemical Industry

1. Crude oil

Crude oil is Russia's most fundamental interest and the factor that has the greatest impact on the international oil and gas market. At present, the interests of all parties in the global crude oil market are complicated. On the one hand, in the past few years, due to the uncertain prospects for the development of the world economy, the demand for crude oil is expected to decrease. This has dealt a heavy blow to countries that mainly export foreign exchange from crude oil, such as Russia and Saudi Arabia. But at the same time, due to the shale oil revolution, the United States has recorded a record growth in production and exports. During the period of low oil prices, the United States has successfully seized a lot of market shares and has become the world's largest producer and seller of crude oil. On the other hand, as the new crown epidemic eased slightly and the economies of European and American countries bottomed out, international oil prices began to rise again, which brought additional purchase costs to crude oil importing countries. Today, the outbreak of a war between Russia and Ukraine will inevitably affect Russia’s crude oil production and exports. The Biden administration will continue to impose sanctions on Russia, which is not intended to make things worse. So, after the Russian-Ukrainian war, what impact will it have on my country's crude oil supply chain?

First, changes in oil prices have a fundamental impact on my country's crude oil imports. my country's crude oil has been highly dependent on foreign countries for a long time. According to statistics from our Petrochemical Federation, in 2021, my country's crude oil imports will be 513 million tons, and the crude oil dependence on foreign countries will be about 72%. In 2020, my country's crude oil imports will be 540 million tons, and the foreign dependence on crude oil will be about 73.6%. Correspondingly, my country's annual import cost of crude oil is as high as 170 billion US dollars, or about 1.2 trillion yuan. Therefore, the slight change in oil prices will be an astronomical figure for the cost of crude oil purchases in my country. According to the report just now, the price of Brent crude oil broke through the $100 mark in a short time.

Second, it may affect my country's refining and chemical integration projects. According to statistics from Longzhong Information, from 2018 to 2022, domestic refining capacity will continue to rise, especially the growth of private refining capacity will be very obvious. It is expected that a processing capacity of about 100 million tons will be put into production. It will reach about 980 million tons, and the annual crude oil processing volume will reach about 700 million tons. If my country's annual crude oil output of nearly 200 million tons is excluded, that is to say, after the completion of these projects in 2022, my country's annual excess oil refining capacity will be about 780 million tons. According to the calculation of my country's imported crude oil of 500 million tons in 2021, the national If the refinery is running at full capacity, it will need to import nearly 300 million tons of crude oil. 300 million tons of crude oil? What a forex outlay this would be! Therefore, for the current domestic refining and chemical integration projects, the raw material side will definitely be greatly affected, and the main products of refining and chemical integration projects are different from traditional refineries. They mainly produce downstream chemicals, so downstream The chemical market will also have a certain degree of impact.

Third, the rise in oil prices has played a major role in promoting my country's energy transformation, vigorously developing clean energy, and achieving the dual-carbon goal. Reducing the dependence on crude oil and increasing the proportion of clean energy use has always been one of the energy strategies pursued by my country. Especially in recent years, with the implementation of the dual carbon goal and the pressure of environmental protection and energy consumption, the transformation and upgrading of the energy and chemical industry has been It is imminent, and external geopolitics pushes up oil prices, which is likely to force the pace of domestic industrial upgrading. Long-term pain is not as short as short-term pain, prompting domestic enterprises to develop and progress in the direction of cleanliness, high efficiency and low consumption.

Finally, another important environment has to be mentioned. In recent years, after the outbreak of the new crown epidemic, the United States released water, which led to increased inflation. Especially in 2021, global commodities are skyrocketing, so for European and American countries, they actually do not want to see oil prices skyrocketing. Under such circumstances, the European and American central banks are likely to be forced to speed up the tightening of monetary policies, leading to a rapid rise in global interest rates and a strong impact on world economic recovery and financial markets. In 2022, my country's economic environment itself will be under great pressure. After 2021, the energy and chemical industry will achieve the best results in history under the condition of rising raw material prices. However, in 2022, under the influence of multiple unfavorable factors, my country's energy and chemical industry will be affected Development is bound to face enormous challenges.

2. Natural gas

According to Cowen, Russia exports about 23 billion cubic feet of natural gas a day, accounting for about 25 percent of global trade, with 85 percent of that gas going to Europe. In particular, the network of Russian gas pipelines to Europe via Ukraine could be disrupted during the military conflict. The pipeline network transports about 4 billion cubic feet of gas to Europe at full capacity per day, but the current flow is only 50% of full capacity, Cowen said.

At the same time, data show that from January to December 2021, China's natural gas imports amounted to 360.10 billion yuan, an increase of 56.3% compared with the same period in 2020. Since 2021, the overall price of imported natural gas in China has shown a substantial increase, the price of imported pipeline gas has been relatively stable, and the price of imported LNG has risen significantly. In 2021, China's LNG import source countries will be 27 countries, an increase of 3 countries from 2020. Among them, Australia's import volume still ranks first, accounting for 39% of the import volume. The United States accounted for 11%, ranking second, followed by Qatar, Malaysia, Indonesia, and the Russian Federation. In 2021, China will import pipeline gas from 6 source countries, namely Turkmenistan, Russian Federation, Kazakhstan, Uzbekistan, Myanmar, and the United States. China's pipeline gas imports from the Russian Federation will increase significantly in 2021, up 154% year-on-year. Russia has now become China's second largest supplier of pipeline natural gas.

First of all, the price of natural gas has basically converged with the price of crude oil. According to data, on February 23, the price of LNG was 9,327 yuan/ton, while in early February, the price was only about 5,200 yuan/ton. Influenced by the situation in Russia and Ukraine, the recent LNG price It has nearly doubled. Since Europe is the region that uses the most natural gas, once the "Beixi-2" shuts down and Russia cuts off the supply, the global natural gas price will undoubtedly rise sharply, and my country must also face the increased cost of natural gas imports. But on the whole, the stability of natural gas in my country can be controlled, and the import source country channel will not be greatly affected.

Secondly, it is good for my country's pipeline natural gas negotiations. As we all know, the pipeline natural gas between my country and neighboring countries is one of the important sources, especially with Russia, there are three natural gas pipelines in the east, far east and west. In recent years, due to the large fluctuations in the amount of natural gas supplied by some countries to my country in winter, natural gas shortages often occur in some areas of my country. However, in natural gas negotiations with Russia, people have the initiative, so my country has always been relatively passive. Now, if Russia's natural gas to Europe is interrupted, the energy export that is the mainstay of Russia's economy, Putin must consider where the next exporter of natural gas will be after completely cutting off natural gas to European countries, then he will inevitably turn his head Negotiations with my country, hoping to digest the amount of natural gas transported to Europe, is very beneficial to my country's import of natural gas through pipelines.

3. Energy and chemical trade

According to the latest statistics from our federation, in 2021, my country's energy and chemical import and export trade volume will reach 860.08 billion US dollars, a year-on-year increase of 38.7%. On the one hand, costs have increased due to the sharp rise in raw material prices, and on the other hand, the import and export business has not recovered since the European and American countries were affected by the epidemic, and some markets were acquired by Chinese companies. Third, my country's adherence to the policy of stabilizing foreign trade is continuing to make efforts, and domestic industrial upgrading has improved the overall competitiveness of products.

With the outbreak of the war between Russia and Ukraine, the geopolitical crisis has become more and more prominent, and commodity prices are bound to rise further, and the rise in commodity prices will continue to lead to increased inflationary pressure. The most direct impact on my country's energy and chemical trade should be the United States. Increase the intensity of interest rate hikes. The interest rate hike will definitely benefit the export of my country's energy and chemical products.

Today's global economy can be said to affect the whole body. As the anchor of the global economy, China will also be affected to a certain extent. But as the only country in the world with a full industrial sector, China has a strong ability to resist shocks. When the external market is sluggish, it is also a once-in-a-lifetime opportunity for my country to expand overseas markets and stimulate the domestic market!

(Source: China International Petrochemical Conference, the author of this article: China Petroleum and Chemical Industry International Capacity Cooperation Enterprise Alliance, the interview record is from Pang Guanglian, if there is any infringement, please inform and delete)

新闻动态

Address: Dongke Street, High-tech Industrial Park, Fushun City, Liaoning Province

www.dongkechem.com

Tel:024-56531111

Fax:024-57671055

Copyright: Dongke Group Powered by 300.cn Shenyang 辽ICP备2021011004号-1

024-56531111

024-56531111 dongke_kfzx@dongkechem.com

dongke_kfzx@dongkechem.com